About Your Tax Bill

The City of Markham makes it easy to understand your tax bill.

See below to find out when your taxes are due, log in to your tax account, find detailed information about payments, and more!

- My Tax Account - ePropertyTax

Log in to My Tax Account - ePropertyTax.

- Tax Due Dates

Residential Interim

- February 5, 2026

- March 5, 2026

Commercial/Industrial Interim

- February 5, 2026

- March 5, 2026

2026 Pre-Authorized Tax Payment (PTP) Plan Withdrawal Dates:

Plan

Residential

Commercial/Industrial

4 Installments

February 5, 2026 and March 5, 2026

February 5, 2026 and March 5, 2026

6 Installments

February 5, March 5 and April 7, 2026

February 5, March 5 and April 7, 2026

11 Installments

February 1, March 1 and April 1, May 1 and June 1, 2026 Not available

ePropertyTax — View | Manage | Pay

A simple, secure and convenient way to manage your property taxes - visit My Tax Account - ePropertyTax.

Important Notes:

- Even if you do not receive a property tax bill or statement, you are responsible for paying your property taxes.

- If you do not pay your bill by the due date, the City will charge penalties on late payments.

- The City will charge you an extra fee if your cheques cannot be processed and does not make payment. Make sure that you sign and fill out your cheque properly.

- Effective January 1, 2020 — No cash payments are accepted for property taxes.

Late payments

If your payment is late, the City will add a 1% penalty to the unpaid amount of your installment. Each month that your payment is late, the City will charge an interest fee of 1.25% on the outstanding amount. This charge will be added on the first day of each month for as long as your taxes stay unpaid.

Penalty and interest charges are set by City of Markham by-laws, which are enforced by the Municipal Act, 2001. City of Markham Council and staff do not have the authority to waive or alter penalty and interest charges.

- Average Residential Tax Bill Amount

The 2025 average current value assessment (CVA) of a residential home in Markham is $833,326.

- 53.67% of your payment goes to the Region of York.

- 24.48% your payment goes to the City of Markham.

- 21.85% of your payment funds education.

2025 CVA City Region Education Total $833,326 $1,428.45 $3,132.16 $1,274.99 $5,835.60 How Your Property Tax Dollar is Spent

How Every Property Tax Dollar is Spent

Every tax dollar given to the City of Markham funds the following municipal activities:

- Fire & Emergency Services — $0.29

- Roads, Bridges & Sidewalks — $0.22

- Library Services — $0.11

- Parks Maintenance — $0.11

- Waste, Recycling & Environmental Management — $0.11

- Recreation Services — $0.11

- Arts & Culture — $0.02

- Planning & Development — $0.02

- Bylaw Enforcement & Licensing — $0.01

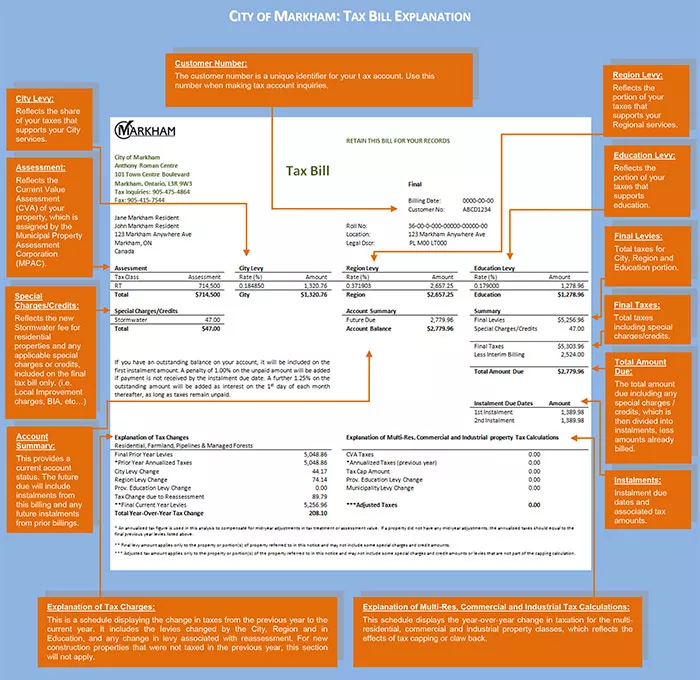

- Understand Your Tax Bill

The City of Markham wants everyone to understand their tax bill. Our Tax Bill Explanation [PDF] show you the most important charges and line items. Use the PDF to understand each section of the tax bill.

The City issues two property tax bills each year, with the first being the Interim property tax bill which are issued in early January and reflect 50 per cent of your previous year’s taxes. The second bill reflects the final property taxes which are issued in early June and reflect any budget changes approved by the City, Region and Province.

For 2026, your interim property taxes are calculated based on 50% of your 2025 total tax levy. The 2026 final tax bills will be issued in June and will incorporate any budgetary increases approved by the City of Markham, Region of York and the Province of Ontario (Education). As articulated within the 2025 property tax brochure, Markham Council approved the City’s 2025 Budget with a 3.88 per cent property tax rate increase. The Region of York and the Province are expected to finalize their respective 2025 budgets by April 2025.

In summary, the 2025 Final Tax Bills that will be issued in June will include a 3.88 per cent increase for the City portion, along with any budgetary increase determined by Region and Province in the coming months.

Please note if you pay your property taxes through the 11 month Preauthorized Tax Payment plan, the interim tax consists of 5 monthly withdraws (Feb – June), whereas the final tax bill consists of 6 monthly withdraws (July – Dec)

If you have any questions, please contact us at 905.477.5530 or customerservice@markham.ca.

- Tax Rates

Check the table below to see the most recent tax rates. You can also click one of the links below to see rates from previous years.

Year: 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998

2025 Tax Rates

Class Description Tax Class City Region Education Total Residential RT/RH 0.171415

0.375863

0.153000

0.700278

Residential - Farmland Await. Dev. R1 0.042854

0.093966 0.038250

0.175070

Residential RL 0.000000

0.375863

0.153000

0.528863

Multi-Residential MT/NT 0.171415 0.375863 0.153000 0.700278 Commercial - Occupied CH 0.228342 0.500687 0.896686 1.625715 Commercial - Occupied CT/DT/ST 0.228342 0.500687 0.880000 1.609029 Commercial - Occupied

C7 0.228342 0.500687 0.880000 1.609029 Commercial - Occupied GT 0.228342 0.500687 0.880000 1.609029 Commercial - Excess Land CJ 0.228342 0.500687 0.896686 1.625715 Commercial - Excess Land CU/DU/SU 0.228342 0.500687 0.880000 1.609029 Commercial - Vacant Land CX 0.228342 0.500687 0.880000 1.609029 Commercial - Farmland Await. Dev. C1 0.042854 0.093966 0.038250 0.175070 Industrial - Occupied IH 0.281669 0.617618 0.980000 1.879287 Industrial - Occupied IT/LT 0.281669 0.617618 0.880000 1.779287 Industrial - Excess Land IK 0.183085 0.617618 0.980000 1.780703 Industrial - Excess Land IU 0.281669 0.617618 0.880000 1.779287 Industrial - Vacant Land IX 0.281669 0.617618 0.880000 1.779287 Industrial - Farmland Await.Dev. I1 0.042854 0.093966 0.038250 0.175070 Pipelines PT 0.157530 0.345418 0.880000 1.382948 Farmland FT 0.042854 0.093966 0.038250 0.175070 Managed Forest TT 0.042854 0.093966 0.038250 0.175070 Markham Village BIA 0.270380 Unionville BIA 0.383297

Federation of Agriculture 0.001229

- Fees & Charges

Section of the Municipal Act S.O. 2001, Chapter C.25 provides authority for City Council to levy fees.

By-Law 2002-276 / 2009-2 allows the City of Markham to impose fees or charges for services or activities provided or done by the City of Markham as follows:

Corporate Services - Tax and Assessment (Effective January 1, 2026)

Type

Fee

Assessment Roll Printout (per roll number)

$4.00

Cheque Recall from Bank (per transaction)

$9.00

Income Tax Receipt Administration Fee (per tax account and tax year)

$31.00

Mortgage Account Administrative Fee (per account, bi-annually)

$19.00

New Tax Account Set Up Fee (per new tax roll number)

$95.00

Non-property tax related charge added to the tax account (per charge)

$81.50

Ownership Change Administration Fee (per update)

$70.50

Property Tax Overdue Notice Fee (fee basis per notice)

$30.00

Returned Cheque Fee (per cheque)

$56.50

Search Fee - Off System (per year/roll number)

$25.00

Search Fee - On System (per year/roll number)

$12.00

Statement of Taxes

$31.50

Tax Certificate* (per certificate)

$146.00

Expedited Tax Certificate* (per certificate)

$146.00 *City will process Tax Certificates requests online only.

- Tax Brochure

View the current Tax Bill Brochure for the latest tax updates and news.

Contact

101 Town Centre Boulevard

Markham, ON, L3R 9W3

Hours

8:30 AM to 4:30 PM